Wyandotte County Real Estate Records

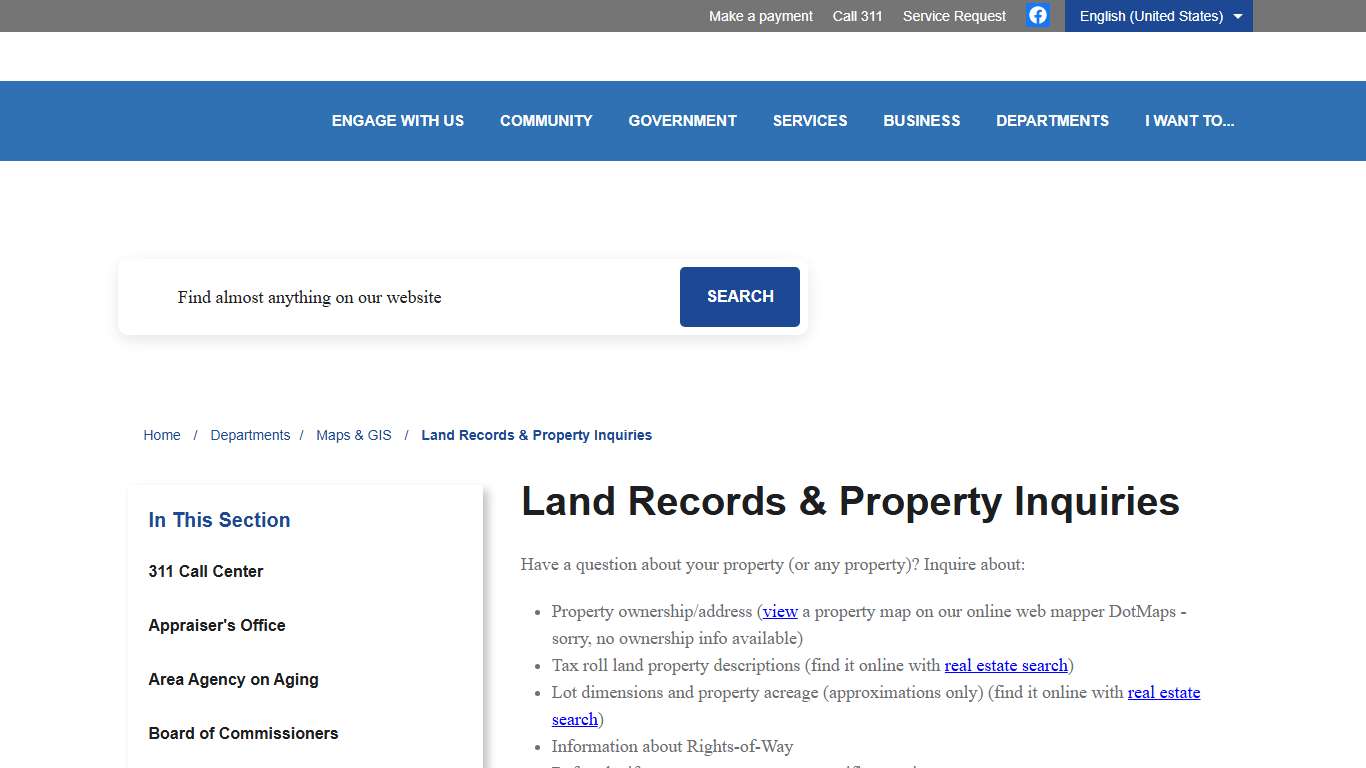

Land Records & Property Inquiries

Land Records & Property Inquiries Have a question about your property (or any property)? Inquire about: - Property ownership/address (view a property map on our online web mapper DotMaps - sorry, no ownership info available) - Tax roll land property descriptions (find it online with real estate search) - Lot dimensions and property acreage (approximations only) (find it online with real estate search) - Information about Rights-of-Way - Referr...

https://www.wycokck.org/Departments/Maps-and-GIS/Land-Records-and-Property-Inquiries

Register of Deeds

... estate-related firms that require daily access to county records ... Unified Government of Wyandotte County and Kansas City, Kansas | Powered by Granicus.

https://www.wycokck.org/Departments/Register-of-DeedsReal Estate & Personal Property Tax

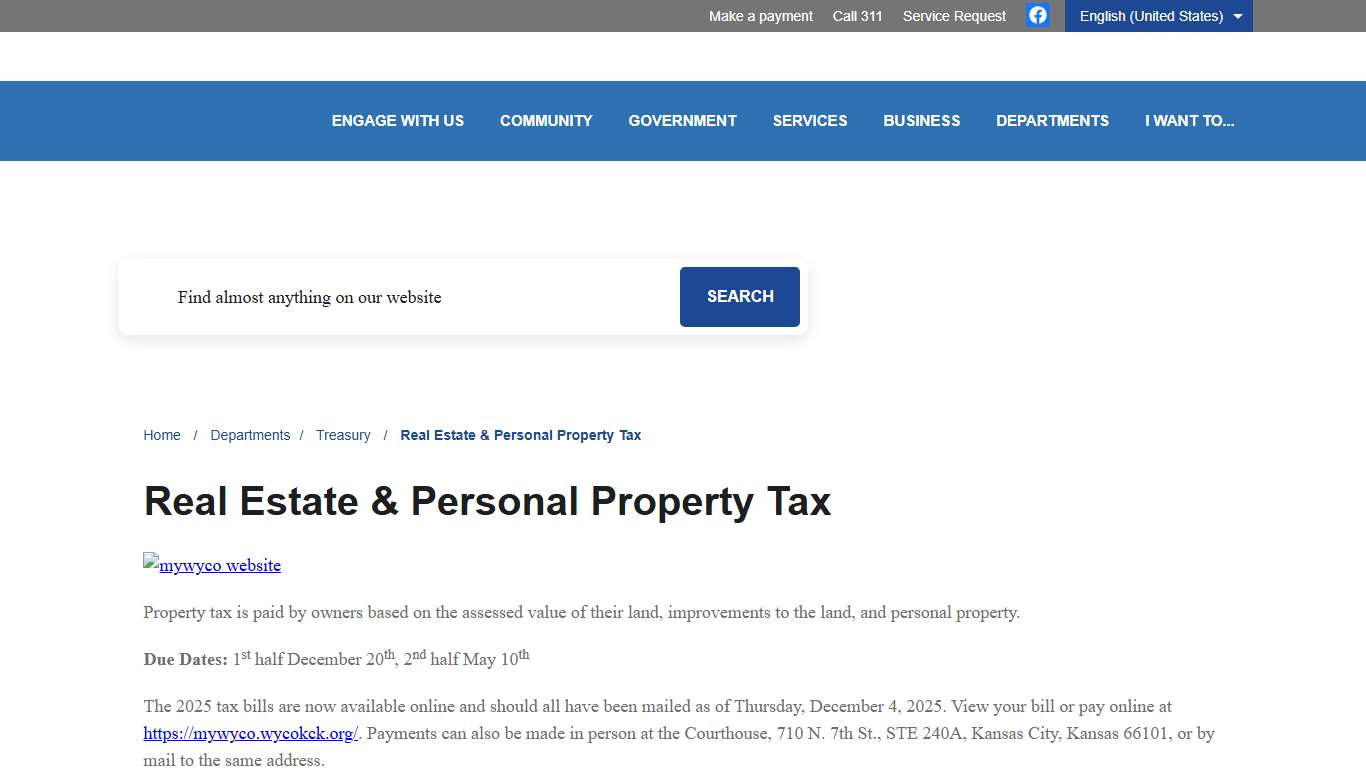

Property tax is paid by owners based on the assessed value of land, any improvements made on it, and personal property.

https://www.wycokck.org/Departments/Treasury/Real-Estate-and-Personal-Property-Tax

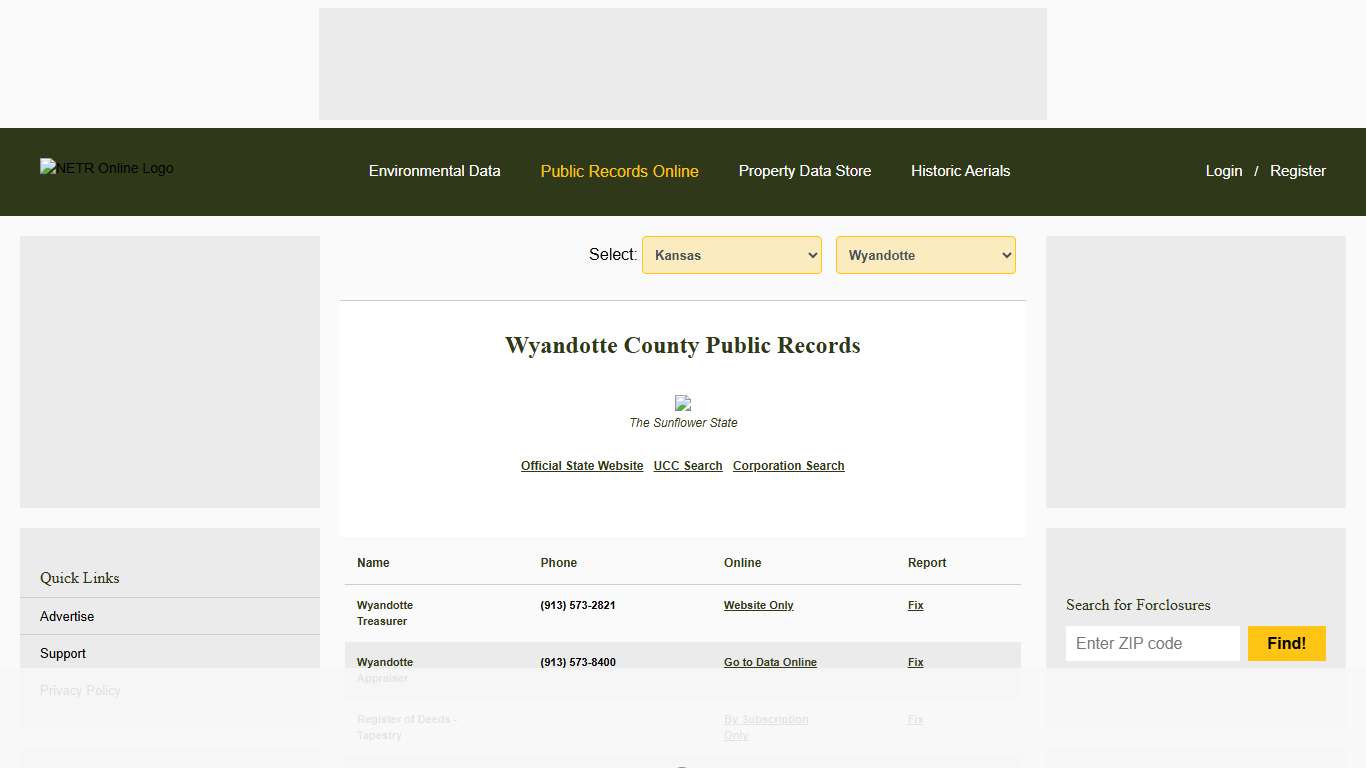

NETR Online • Wyandotte • Wyandotte Public Records, Search Wyandotte Records, Wyandotte Property Tax, Kansas Property Search, Kansas Assessor

Select: Wyandotte County Public Records The Sunflower State Wyandotte Treasurer (913) 573-2821 Wyandotte Appraiser (913) 573-8400 Register of Deeds - Tapestry Wyandotte Register of Deeds (913) 573-2841 Wyandotte Mapping / GIS (913) 573-2941 Wyandotte NETR Mapping and GIS Help us keep this directory a great place for public records information. Submit New Link Products available in the Property Data Store...

https://publicrecords.netronline.com/state/KS/county/wyandotte

Wyandotte County approves 2026 budget with property tax ...

Wyandotte County approves 2026 budget with property tax increases for residents. Mayor Tyrone Garner vetoed the budget, but his action was ...

https://www.kshb.com/news/local-news/wyandotte-county-approves-2026-budget-with-property-tax-increases-for-residentsKansas Department of Revenue Property Valuation Home Page

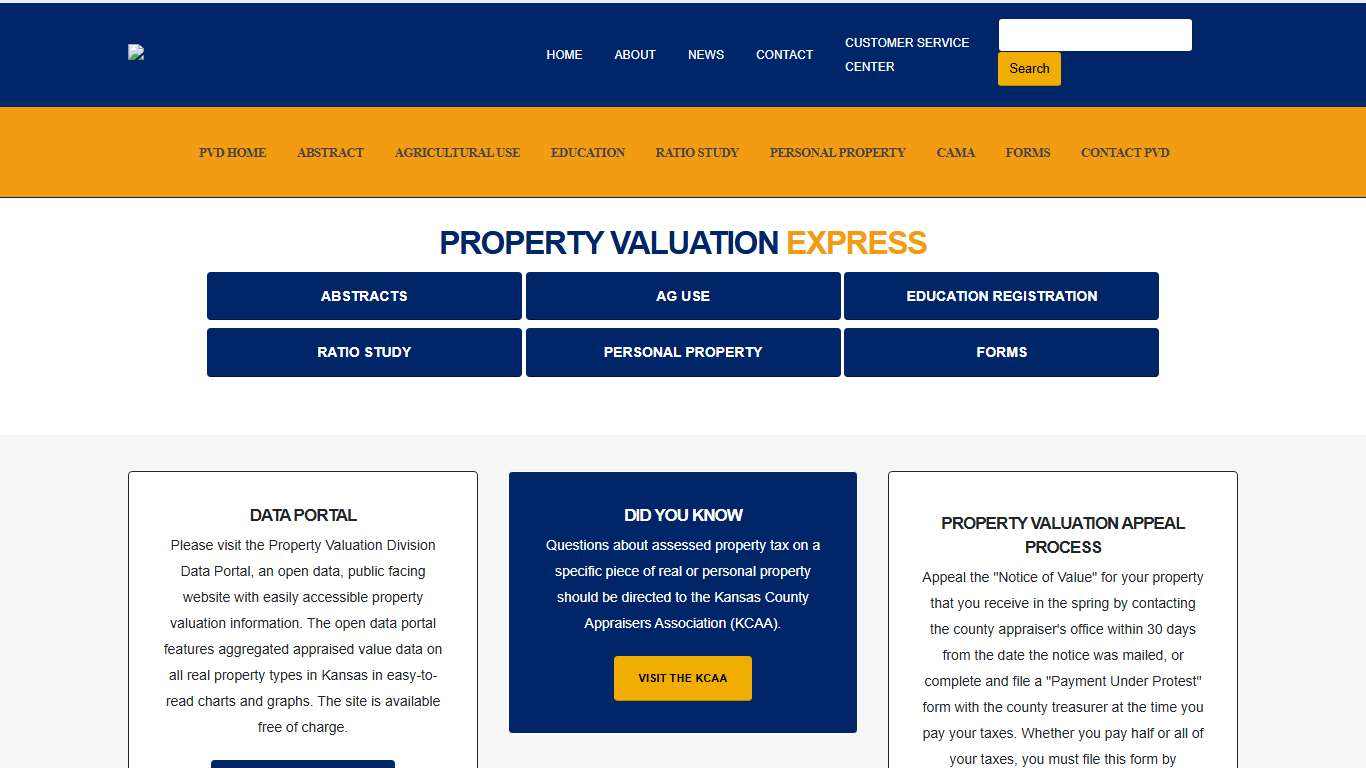

DON'T PUT IT OFF! Taxpayers have 30 days from date county mailed notice to file Equalization Appeal. Please visit the Property Valuation Division Data Portal, an open data, public facing website with easily accessible property valuation information. The open data portal features aggregated appraised value data on all real property types in Kansas in easy-to-read charts and graphs.

https://www.ksrevenue.gov/pvdindex.html

Wyandotte County approves 2026 budget with property tax increases for residents - YouTube

NaN / NaN In this video Transcript Description 4Likes 269Views Sep 152025 Transcript Follow along using the transcript. Show transcript KSHB 41 194K subscribers Transcript Show more...

https://www.youtube.com/watch?v=gPU88Dpg2jA

Wyandotte County Property Tax Protestors There is also another court date March 30, 2026 , for the same issue Facebook

There is also another court date March 30, 2026 , for the same issue. So we’re putting in a lot of time effort into getting this money back to the taxpayers I’m sorry that you don’t appreciate it but that’s what we’re doing and it’s not costing a taxpayer dime we’re doing this on our own there’s three of us it’s working on this, it’s like an 80 hour work...

https://www.facebook.com/groups/677921707281561/posts/1424901292583595/

Pay Taxes Online Treasurer

Share: Font Size: Pay Taxes Online Property Search Cannot find address ? Enter the name of the street without the ending ‘Street’ or ‘Avenue’. Enter the first three letters of the street name and all the streets starting with those letters will be searched.

https://pta.waynecounty.com/

Kansas Department of Revenue Property Valuation Home Page

DON'T PUT IT OFF! Taxpayers have 30 days from date county mailed notice to file Equalization Appeal. Please visit the Property Valuation Division Data Portal, an open data, public facing website with easily accessible property valuation information. The open data portal features aggregated appraised value data on all real property types in Kansas in easy-to-read charts and graphs.

https://www.ksrevenue.gov/pvdindex.html

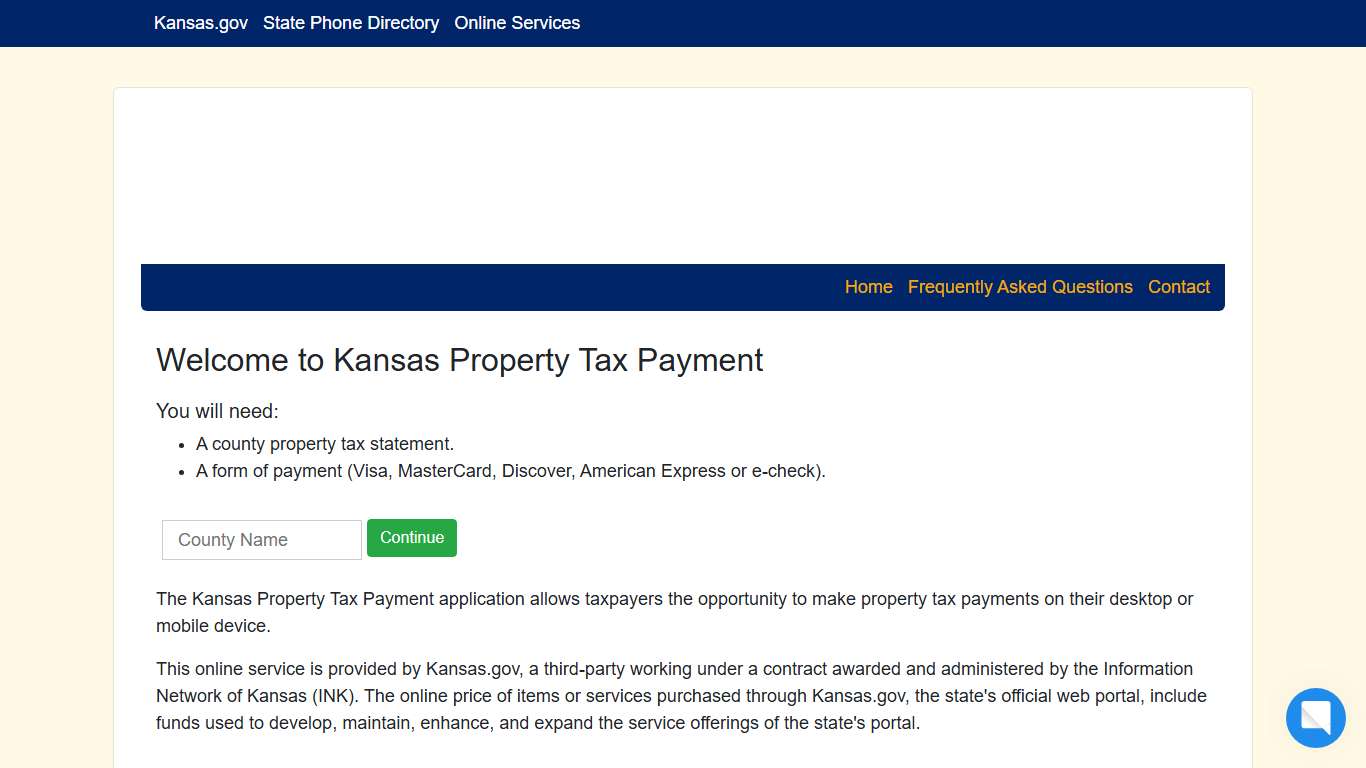

Kansas Property Tax Payment

Welcome to Kansas Property Tax Payment You will need: - A county property tax statement. - A form of payment (Visa, MasterCard, Discover, American Express or e-check). The Kansas Property Tax Payment application allows taxpayers the opportunity to make property tax payments on their desktop or mobile device.

https://www.kansas.gov/propertytax/

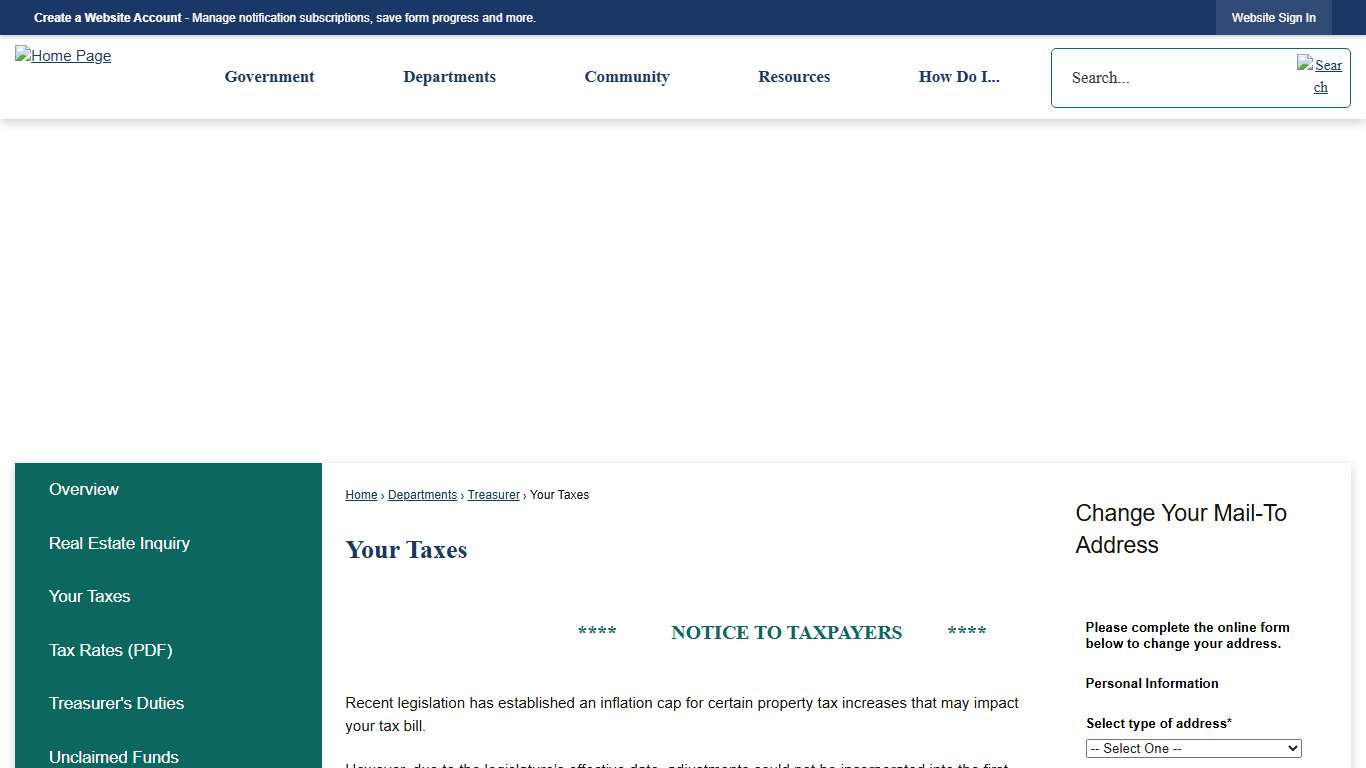

Your Taxes Wyandot County, OH

Your Taxes **** NOTICE TO TAXPAYERS **** Recent legislation has established an inflation cap for certain property tax increases that may impact your tax bill. However, due to the legislature’s effective date, adjustments could not be incorporated into the first half tax bills.

https://co.wyandot.oh.us/195/Your-Taxes

Real Estate

Share your experience with our website.

https://www.wycokck.org/Community/Land-Housing-and-Real-Estate/Real-Estate

Wyandotte County, KS Property Tax Calculator 2025-2026

Calculate Your Wyandotte County Property Taxes Wyandotte County Tax Information How are Property Taxes Calculated in Wyandotte County? Property taxes in Wyandotte County, Kansas are calculated based on your property's assessed value multiplied by the local tax rate. The county's effective tax rate of 1.54% is applied to determine your annual property tax obligation.

https://propertytaxescalculator.com/kansas/wyandotte-county

Higher bills likely for Wyandotte County residents after commission unfreezes property taxes KCUR - Kansas City news and NPR

Property tax increases in Kansas City, Kansas, and Wyandotte County are likely in the coming fiscal year. The Unified Government Board of Commissioners voted Wednesday night to allow property taxes to rise up to three mills. That would be about a $144 hike on a $200,000 house in Kansas City, Kansas.

https://www.kcur.org/politics-elections-and-government/2025-07-17/higher-bills-likely-for-wyandotte-county-residents-after-commission-unfreezes-property-taxes